Books can be an escape from reality and a pure pleasure. It can also be a great way to learn something new and get inspired for personal development. In this article, we pick out some of the most readable books on money and finance on the market.

In the areas of finance and personal development, there are some really good non-fiction books that we can all learn a lot from. Autobiographies are also very useful as they often give you a deeper insight into the thoughts of different people.

There’s a lot to learn from other people’s experiences and books are a really good way to absorb the lessons.

1. Money: Master the Game – Tony Robbins

Napoleon Hill’s 1937 book Think and Grow Rich is often cited as one of the best books written in the field of personal development. Over two decades in the early 20th century, Napoleon Hill interviewed 500 of the most prominent individuals of the time, such as Andrew Carnegie, Henry Ford and Thomas Edison, to unravel the secrets of their successes.

He found that they all shared the same focus on their goals and that it was this, combined with a burning desire, belief in their abilities and tenacity, that made them successful.

Hill’s message that ordinary people could overcome obstacles and become successful instilled hope in a whole generation of readers struggling through the Great Depression of the 1930s and Think and Grow Rich became one of the best-selling books of all time.

It is also this book that served as inspiration when Tony Robbins, one of the most famous personal development inspirers of our time, released his third book Money: Master the Game. The book is over 600 pages long and a real powerhouse for anyone interested in both finance and personal development.

The book is not a traditional self-help book, but it gives you a lot of practical tips on both how to act and think to be successful when it comes to managing your personal finances. He does this partly by methodically outlining typical personal finance mistakes we make and partly by showing how we can become better at thinking as successful investors in different situations.

An interesting part of the book is the chapter “Invest like the .001%: The Billionaires Playbook”. In this chapter there are personal portraits, along with interviews where Robbins tries to unravel the secrets of these people’s successes.

That he profiles twelve of the most successful investors of our time, including Ray Dalio, John C. Bogle, Warren Buffett and Sir John Templeton, makes it truly readable and instructive.

In a separate chapter of the book, Robbins also outlines Ray Dalio’s “All Season Strategy”, an investor’s strategy to ensure that the portfolio delivers returns in good times as well as bad. Something that is also relevant today.

2. The road to financial freedom – Bodo Schäfer

This book contains some excellent tips on how to challenge yourself while building your financial muscles. It is a well-known truth that we don’t get rich just by earning a high salary. In fact, we often adjust our spending to our income and upgrade our lifestyle in proportion to the increased income. If we can’t save when our income is low, we are unlikely to be able to save when our income increases.

This is why it is quite popular in books on personal finance to point out that we should always start by paying ourselves before taking care of other expenses, so as to leave ourselves no other option than to live according to the monthly budget. Usually these tips involve taking a percentage of your salary, such as 10% of your monthly salary each month, and putting it away in a savings or investment account.

Schäfer also offers a different kind of challenge in his book The Road to Financial Freedom. According to this model, you should get an account on which you deposit every month for 18 months an amount that is twice as large as the previous month. According to Schäfer, 18 months should give you enough time to acquire new and expanded sources of income. The advantage of this model is that it challenges your creativity and makes you more inclined to take on new challenges with a clear goal in mind.

We see from the model that the stakes are modest at first and that for a person on a normal income things start to get really tough around the 14th month. The idea is also that by that time you should have found something that starts to generate additional income. Although the model may seem rather unrealistic at first glance, it is a good example of how you can introduce more concrete goals into your personal finances to build your “personal finance muscle”.

The problem with most of us is that we often don’t have concrete enough objectives for the financial goals we want to achieve. This often leaves us setting diffuse goals about what we want to achieve. If we have more concrete numbers to work with, we often get more creative about the strategies we use to achieve them. Are there opportunities to earn extra money on the side? Are there fees to scale back to have more money to put away each month?

This was only part of what’s in the book when it comes to acquiring the right thinking tools to become a master at managing money. A really readable book, with both inspiration and practical tips.

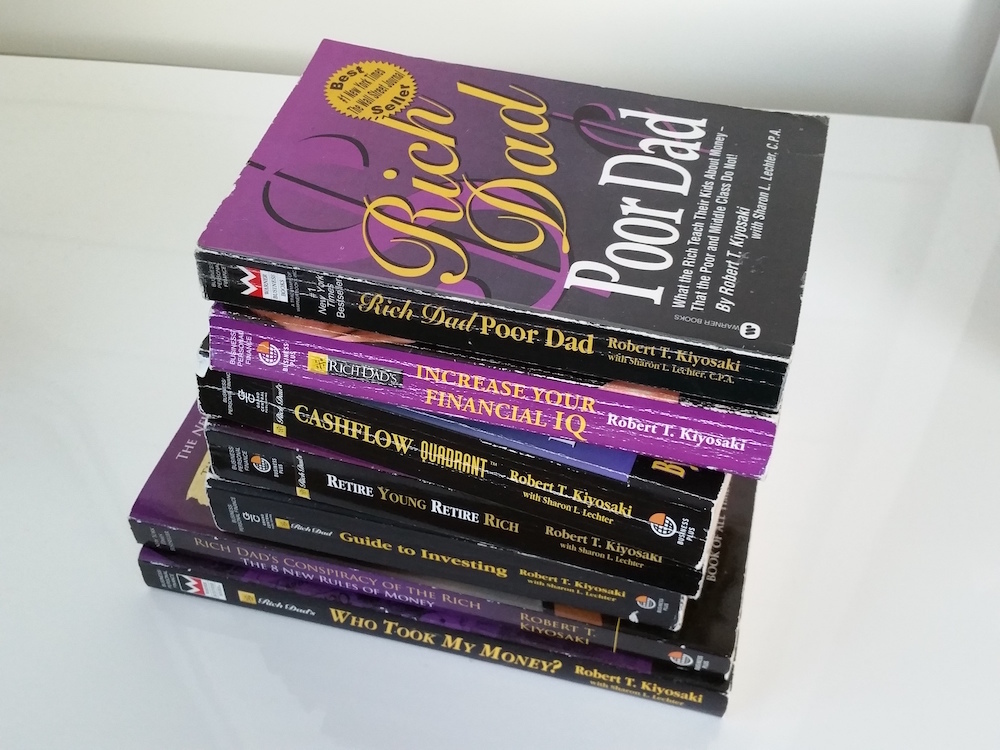

3. Rich Dad, Poor Dad Series – Robert T. Kiyosaki

No one else can write about finances in such a simple and readable way as Robert T. Kiyosaki. It’s also one of the secrets to his success as an author. He has written more than 26 books, which have sold more than 27 million copies and been translated into 51 languages.

Robert Kiyosaki got his big breakthrough as an author with the self-help book Rich Dad, Poor Dad. In the book, Kiyosaki talks about what he learned from “his rich dad”, according to Kiyosaki, a childhood friend’s father who became Kiyosaki’s personal finance mentor. Kiyosaki’s own biological father (the book’s “Poor Dad”) was, according to Kiyosaki, highly educated and had a successful career, but he still came to be a personal finance failure while “rich dad”, who lacked higher formal education, became very rich.

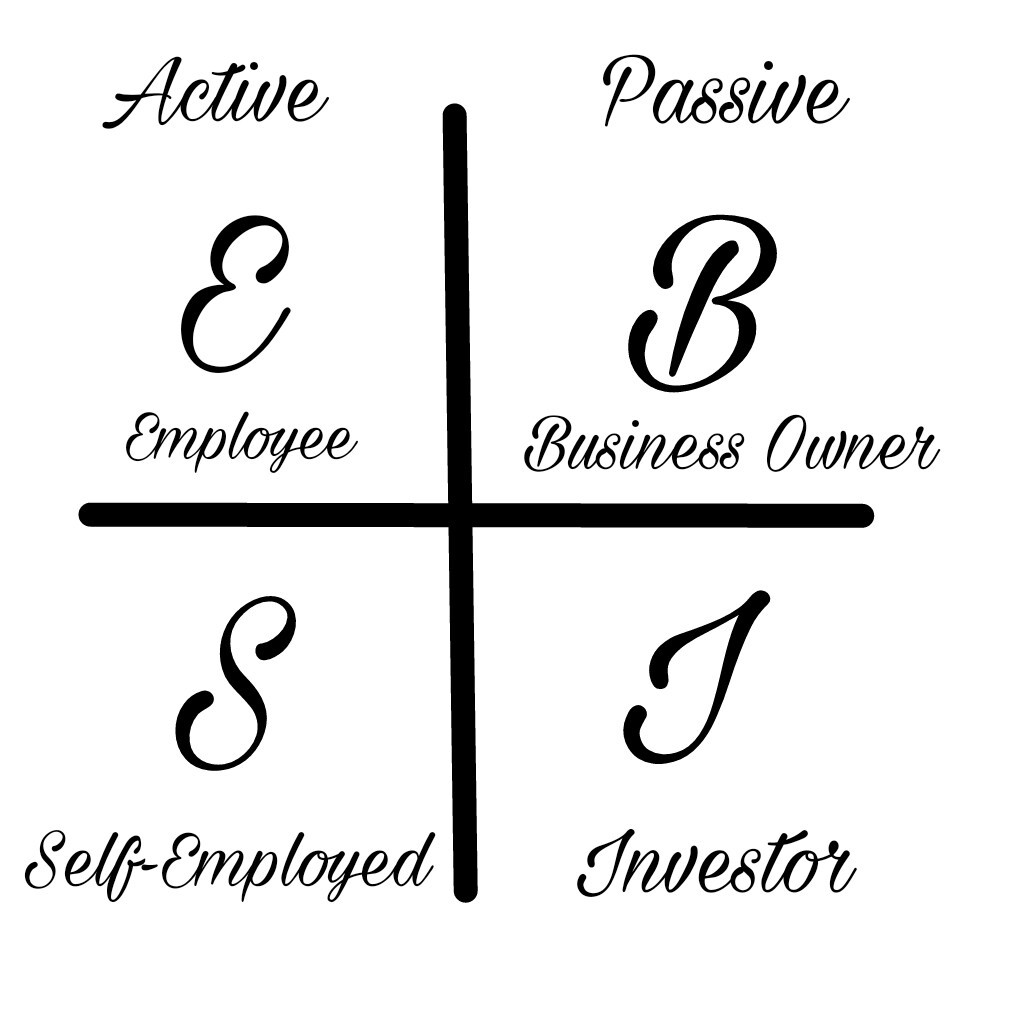

In simple terms, the message of the books is based on the following model:

According to Kiyosaki, it is preferable to stay on the right side of this model because in these cases one is not limited by the amount of time one spends at work for one’s income. People who have managed to build up a portfolio of e.g. real estate, businesses and the like that do not in themselves require one’s presence to generate cash flows have a much better chance of succeeding in becoming financially independent. In contrast, people on the left-hand side of the model earn money only in relation to their work effort.

If one wants to be critical, one can point out that the model as well as his books helped to create a whole generation of opportunistic real estate speculators, an area in which Robert Kiyosaki also built his fortune. However, as a thinking tool, the books are very inspiring, especially as they are linked to a good and instructive story.

However, before you rush in to buy your first homes for rental purposes, it is important to remember that we are in a different position than the author was in when he bought his first properties.

Indeed, low interest rates combined with quantitative easing have been fuelling prices and creating bubbles in most asset classes for almost 10 years.

But as inspiration, the books are really good. The unique thing is that Kiyosaki has managed to add new interesting topics in all of his books, even though they are all based on the same idea around the cash flow quadrant. Below are the seven books of the series:

- Rich Dad, Poor Dad (1997)

- Cashflow Quadrant (1998)

- Rich Dad’s Guide to Investing (2000)

- Retire Young Retire Rich (2002)

- Who took my money? (2004)

- Increase Your Financial IQ (2008)

- Conspiracy of the Rich: The 8 New Rules of Money (2014)

4. The Snowball: Warren Buffett and the Business of Life – Alice Schroeder

Many books have been written about one of our most famous investors of all time, but few are as exhaustive and personal as this one. If you want to get a deeper understanding of how Warren Buffett the person works and what made him the person he became, this book is recommended.

In just over 800 pages, it contains most of what you need to know about the Oracle of Omaha. There are many people who know how he lived his life over the past decades. But how did his life really begin and how did he take an interest in stocks and investing? Find out all about these questions in this book.